2021-2022: Consolidated Orders and Delivery for

Groceries and Everyday Market

My Role

Contract UI Design | Product Design | User Research | Testing

Tools

Figma | Miro | Adobe Illustrator | Adobe Photoshop.

As Senior UI/Product Designer within the Everyday Market Tribe, I collaborated closely with Lead UX Designer Anastasia Attia to enhance order transparency and the checkout experience on the Woolworths website.

My responsibilities spanned the full design lifecycle, from discovery and early concept ideation to facilitating sprint reviews, delivering regular design huddles to leadership, and handing over final assets for production.

I worked within multiple cross-functional teams, partnering with product managers, engineers, and stakeholders across Content, Legal, Comms, and Product Operations to ensure alignment and delivery of high-quality, customer-centric solutions.

Context Summary

The rollout spans three key phases across the product ecosystem.

1. Everyday Market Multi-shipment and Fulfilment (Q3–Q4 2021)

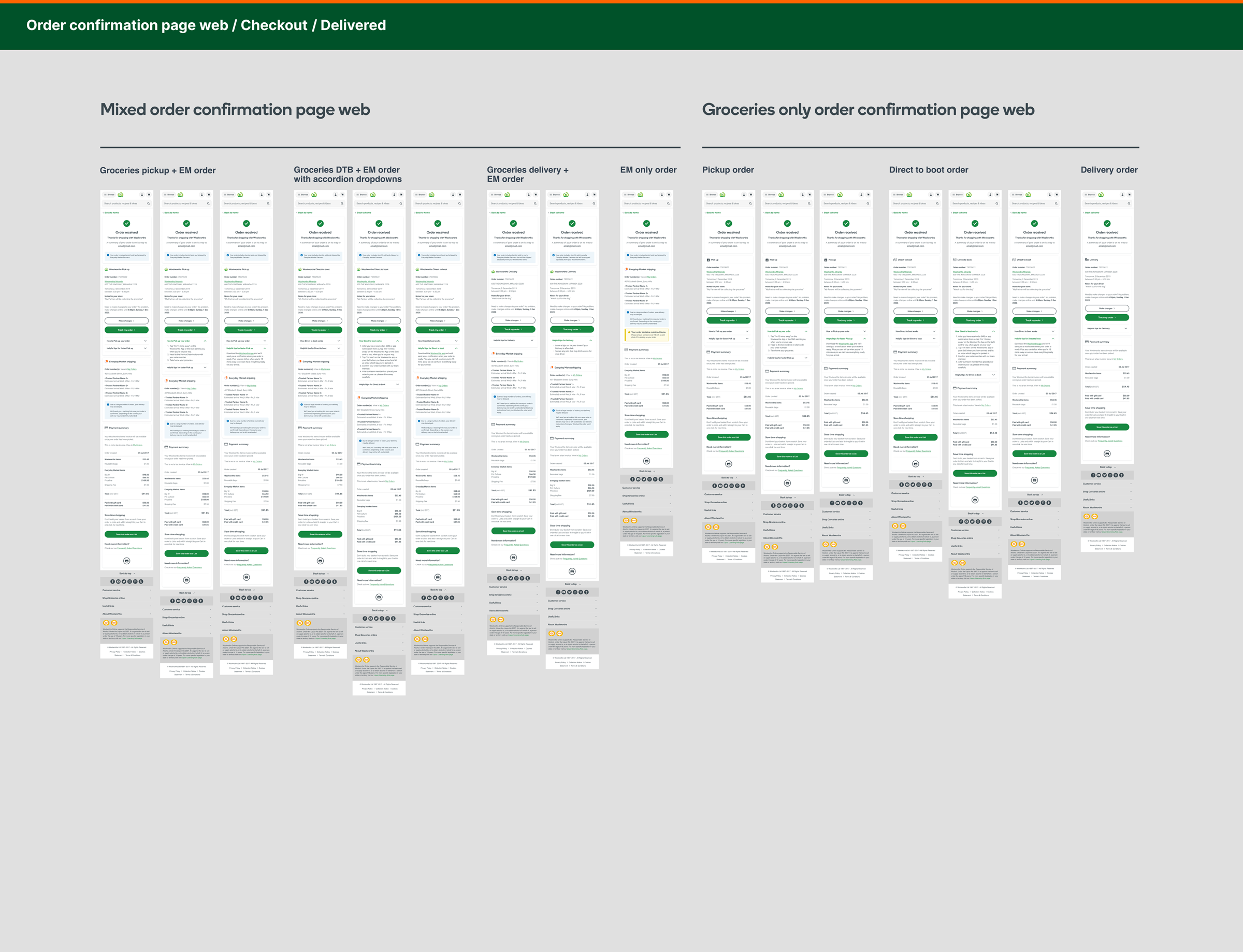

2. Mixed Order Confirmation for Woolworths Grocery & Everyday Market (Q4 2021–Q1 2022)

3. Order Tracking Integration for Woolworths Grocery & Everyday Market (Q1–Q2 2022)

There is currently a disconnect between Woolworths Grocery and Everyday Market experiences. Customers are unaware these are separate operations and perceive them as a single brand and delivery service. This leads to confusion when mixed orders arrive at different times.

Woolworths Grocery items are delivered or available for pickup/direct-to-boot by Woolworths.

Everyday Market items are fulfilled and shipped by partner businesses via external couriers, with no option for pickup or Woolworths delivery.

This lack of transparency highlights the need for more transparent communication about order types, fulfilment, and delivery expectations.

Problem Statement

Focusing on mixed basket delivery and pick-up for customers shopping within both Woolworths groceries and Everyday Market items, without knowing the difference between Woolworths groceries and Everyday Market.

Woolworths grocery orders ship from just three fulfilment centres: Sydney, Melbourne, and Brisbane. Yet, customers typically receive their groceries within two days.

In contrast, Everyday Market items usually take up to 10 business days for delivery. This mismatch, along with a limited understanding of multi-shipment orders, decreases delivery transparency and leads to increased checkout abandonments

A key unknown is what mixed‑basket pickup customers do when faced with shipping fees for Everyday Market items:

Do they remove these items and proceed with their grocery order?

Or do they abandon the session entirely?

Because we don’t capture a customer’s chosen fulfilment method until checkout, the actual impact is likely even greater than we can measure: the sharpest drop‑offs occur after items are added to cart and again during checkout.

Our working hypothesis is that pickup customers, who choose the pickup journey to avoid delivery costs, leave or edit their basket once they discover a shipping fee for Everyday Market products.

The current journey and pain points: Touch-points

Basket

What happens:

Mixed baskets are allowed without any notice that items will ship separately.Customer impact:

Shoppers assume everything will arrive (or be collected) together.Checkout/Delivery vs Pick-up

What happens:

• Grocery orders ship from three fulfilment centres (Sydney, Melbourne, Brisbane) and usually arrive within 2 days.

• Everyday Market orders come directly from partner businesses and can take up to 10 business days.

• Pick-up/direct-to-boot is not available for Everyday Market items.Customer impact:

Customers looking to save on delivery fees choose Pick-up, then discover that Everyday Market items incur a courier charge.

• Surprise fees + split time-frames trigger basket edits or complete abandonment.Analytics gap

What happens:

Fulfilment method is only captured at checkout.Customer impact: Observable effects

We cannot see whether Pick-up shoppers remove Everyday Market items before checkout or abandon the session.

Customer Verbatim’s

“Didn't realise I was ordering from a different company, and then I got another shipping fee. If I decide to order from Woolworths, I expect it to come from Woolworths.”

“If I'm honest, I was anticipating the delivery coming within a day or two, or even with shopping, and it didn't. So I had to go out and buy it elsewhere, as I needed it.“

"I have no idea why they were not delivered with the rest of the order. I have had them delivered several times with my online orders"

“I was disappointed with my whole online order.....I didn't know it would be coming from Big W as we shopped from Woolworths, and if I had known this, I would have chosen a different dog food brand to be delivered with the order”

“Product was available in store, but instead of just putting the product in my order, it was shipped by the market partner and took more than a week to arrive.”

Hypothesis

Suppose delivery options, costs, and time-frames for each item type are made explicit earlier in the journey (e.g., on product pages and in the basket). In that case, customers will make informed choices, resulting in lower abandonment rates and healthier mixed-basket conversion, especially in the Pick-up channel.

The Business Problem

Significant drop-offs occur after Everyday Market items are added to a grocery basket and again during the checkout process.

Higher abandonment in the Pick-up flow is likely driven by customers who expected a free, single-trip collection but instead face a courier fee.

Customers engaging in mixed basket journeys, combining Woolworths Grocery and Everyday Market items, are experiencing confusion and friction across key points in the path to purchase and post-purchase, resulting in drop-offs, missed expectations, and increased business costs.

Key Uncertainties and Gaps:

Basket Abandonment: Are pickup customers removing Everyday Market items and continuing with grocery-only purchases, or are they exiting the session entirely?

Cross-Platform Behaviour: Are customers abandoning mixed pickup flows on the web and switching to the app (where mixed pickup baskets aren’t supported) to complete the transaction?

Time-on-Task Insights: Where in the journey are customers spending the most time? Is this friction due to decision-making, confusion, or unmet expectations?

Session Return & Completion: Are customers adding mixed items to their basket and returning later to complete their order? If so, what’s influencing this delay?

Post-Purchase Pain Points:

Split Fulfilment Confusion: A customer placing a single-seller, multi-item Everyday Market order (e.g., 3 items from Big W) may unknowingly receive these from multiple locations, arriving at different times.

Lack of Tracking Transparency: Customers receive only one order status and one notification set—even when the order is split—because the system doesn’t support split fulfilment visibility.

Increased Customer Service Load: Confused customers are clicking ‘Where’s My Order?’ and calling the CHUB (Customer Hub), incurring unnecessary support costs.

Customer Satisfaction Impact: Inadequate delivery communication is lowering Voice of the Customer (VOC) scores for delivery experience, particularly for Everyday Market.

Business Impact Summary :

Higher drop-off rates during pickup and checkout

Underreported behaviour due to analytics gaps (e.g., no visibility of fulfilment choice pre-checkout)

Increased support costs via CHUB

Declining delivery satisfaction

Missed conversion opportunities due to poor education and fulfilment experience.

Online NON-App:

Let's reduce these numbers!Order to the Checkout Process:

Drop-off rate - 60%

(Pickup and Delivery combined)The Checkout Process:

Drop-off rate - 77%

(Pickup and Delivery combined)Delivery Method:

Cart to Checkout Delivery only- 61%Delivery Method:

Cart to Checkout Pick Up only- 39%

User Goals

We believe that by keeping the user at the centre of the experience, we can create a frictionless and intuitive journey. Success means the customer completes their order with a clear understanding of what they’ve purchased, how it will be delivered, and what to expect next, all with confidence and satisfaction.

By simplifying fulfilment options and making it easier to choose how and when orders are received, we reduce confusion and decision fatigue. This not only saves customers time but also lowers the likelihood of cart abandonment, benefiting both the user and the business.

Business Goals and Opportunity

Business Goals & Opportunities: Woolworths is uniquely positioned to elevate the Everyday Market experience by combining its advanced logistics network with customer-centric design.

Customers engaging in mixed basket journeys, combining Woolworths Grocery and Everyday Market items, are experiencing confusion and friction across key points in the path to purchase and post-purchase, resulting in drop-offs, missed expectations, and increased business costs.

Business Goals:

Leverage Woolworths’ logistics network to deliver a reliable, fast, and consistent marketplace experience for Everyday Market customers.

Build customer trust through a transparent and seamless fulfilment journey that rivals leading e-commerce platforms.

Increase Everyday Market brand awareness by educating customers on what the brand offers, how it works, and what to expect post-purchase.

Create a frictionless experience that feels effortless, from product discovery through to delivery.

Key Opportunities:

Multi-source fulfilment optimisation

Large retailers like Big W often ship from a mix of warehouses and stores based on stock availability.

Everyday Market can mirror this model while offering greater predictability using Woolworths' established logistics backbone.

Expanded fulfilment capacity . Everyday Market and National Products Fulfilment now have dedicated space in three Customer Fulfilment Centres (CFCs), unlocking faster, more consolidated delivery for eligible items.

Customer education and personalisation.

Communicate what Everyday Market is, how it differs from Grocery, and surface personalised fulfilment expectations based on user behaviour, preferences, and location.

Enhanced UI and journey design .

Introduce purposeful UI utility elements such as:

Clear call-to-actions aligned with fulfilment optionsMicro-interactions in order tracking for progress updates.

Process bars to visually guide the checkout journey. These can transform cart and checkout into an immersive, intuitive experience.

Design Principles

Delivering a consistent and user-focused experience required balancing design integrity, technical feasibility, and business constraints within an evolving ecosystem.

Balancing Design with Constraints

The journey has involved navigating several complex and sometimes competing priorities:

Information hierarchy & consistency

Maintaining clarity across mixed journeys, especially where Everyday Market and Grocery intersect, required a

re-evaluation of content structure and prioritisation.User control vs legal & brand compliance

Design decisions had to meet strict legal requirements, brand colour hierarchies, and existing UI library rules. Hard constraints around call-to-actions and interactive elements shaped what was possible.Evolving UI patterns Updates to the core Woolworths design system meant adapting to changing guidelines midstream, while also contributing feedback to evolve the library to serve mixed fulfilment better flows. Build customer trust through a transparent and seamless fulfilment journey that rivals leading e-commerce platforms.

Technical Feasibility

Not all data points required to deliver the ideal experience were available at the time:

Some back-end fulfilment logic and APIs limited what could be shown to users — especially in early checkout and post-order tracking experiences.

The architecture informed which solutions were viable now, and which would need iterative delivery in future sprints.

Despite these limitations, WooliesX continues to unlock capabilities progressively, aligning its backend infrastructure with the vision for the front-end experience.

Solution and New Experience

Customer Insight:

Pickup customers are more price-sensitive

These customers often choose pickup to avoid delivery costs. When confronted with Everyday Market shipping fees at checkout, many abandon their basket or remove Everyday Market items altogether.Current messaging may be too strong. Some existing information panels and error messages are overly rigid or complex, which can potentially confuse users or deter them unnecessarily.

Experience Improvements

Not all data points required to deliver the ideal experience were available at the time:

Clearer, friendlier messaging

Refine how we communicate delivery fees, fulfilment differences, and pickup restrictions. Use helpful, human language that informs without overwhelming.Split order logic & experience. Introduce a logic layer that treats split orders as distinct sub-orders, enabling:

• Item-level fulfilment clarity

• Independent delivery status tracking

• More accurate notifications per shipmentEnhanced order tracking interface

Evolve tracking UX to reflect split deliveries better:

• Visual shipment breakdowns

• Status per item/location

• Progress indicators for each sub-order

Expected Outcomes:

User Benefit and Business Impact:

Clearer expectations

Lower cart abandonment

Increased confidence in order tracking

Higher CSAT

Reduced confusion around split orders

Fewer “Where’s my item?” contacts

Better post-purchase experience

Reduced CHUB load

Design Process: Double Diamond | Triple Diamond

Discovery

Problem | Data | Heuristic evaluation | Competitive analysis | Voice of the Customer (VOC)

Define

Synthesise insights | Feature priority | Requirements

List of features - We prioritised which features were most impacted and started working on T-shirt sizing, and these tasks. This was sometimes done, leading up to Big Rock Prioritisation (BRP) for the slated project, which had its discovery completed before its allocated quarter. We often had discovery slated into the last half of a quarter and before the project’s allocated quarter.Develop

Explore concepts and design | UXR testing | Iterations | Collect feedback | Rinse & Repeat

Two rounds of testing all PASSED

1. Everyday Market Multi-shipment and Shipment Fulfilment

2. Mixed Order Confirmation

3. Order TrackingDeliver

Hi-fidelity UXR testing | Iterations | Collect feedback | Rinse & Repeat | Dev handover

Two rounds of testing all PASSED

1. Everyday Market Multi-shipment and Shipment Fulfilment

2. Mixed Order Confirmation

3. Order Tracking

Conclusions and Learnings

At its core, giving customers clear visibility of their orders and item statuses will reduce post-purchase confusion and decrease reliance on the Customer Hub for updates, ultimately saving the business time and money.

We’ve observed that pickup customers, typically motivated by avoiding delivery fees, are likely to remove Everyday Market items from their baskets once they encounter unexpected shipping costs. While we may not eliminate this drop-off, we can reduce friction by helping these customers build their baskets to meet free shipping thresholds, making it more likely they’ll retain those items.

To support this, we recommend introducing curated Lists and Content Cards—topical, category-based, or time-sensitive to separate Everyday Market and Woolworths products. This will improve scannability, customer immersion, and brand empathy, while increasing awareness of delivery timelines and costs.

These enhancements will also help reduce user friction across the Order Review, Delivery, and Checkout stages, improving both transparency and conversion.